Foreign Remittances Direct to Your Mobile via eZ Cash

Download arma driver. For the first time in Sri Lanka eZ Cash introduces a new and an easy way to instantly receive foreign remittances directly to your mobile from a large network of foreign money transfer agencies across the world via eZ Cash.

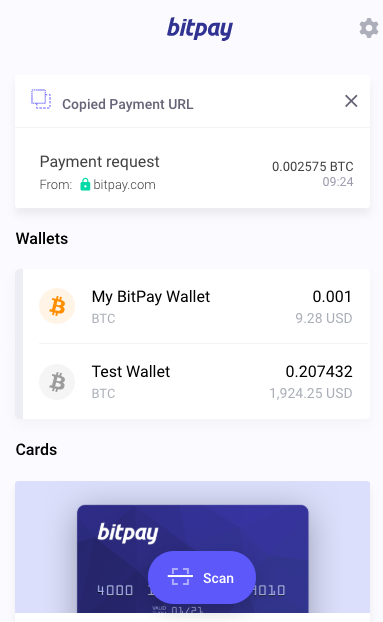

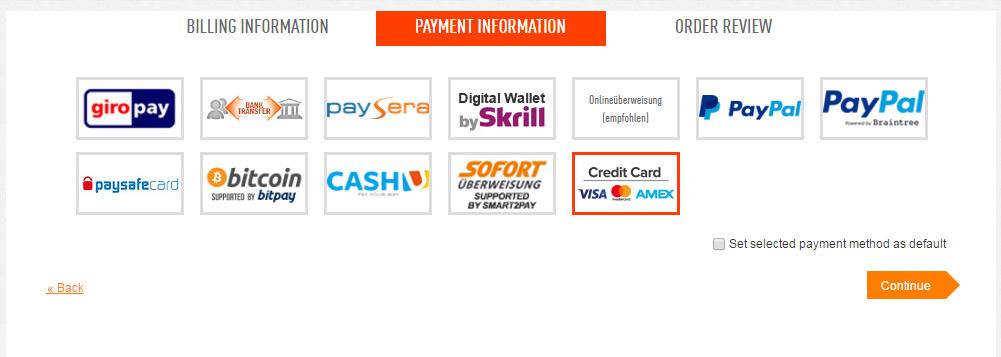

Skrill, how to use bitpay to deposit in online casino which was formerly known as Moneybookers, is one of the most widely accepted payment options at Internet gambling sites. When you are ready to make transactions using the wallet, you can produce a new public wallet address, which is how the site knows where to take the funds from. Exchange PayPal to Skrill. Here are all options for exchange PayPal USD to Skrill USD. The best exchange options with the perfect exchange rate are placed at the top of the monitoring table. All exchangers are verified by administrator so the exchangers monitor contains only trust exchangers with a. Download the BitPay App to securely send, receive and store cryptocurrency. Buy and exchange crypto all in one app. Skrill - Fast, secure online payments. Using your Skrill wallet to pay online at a retailer that accepts Skrill is free Sending money to an international bank account with Skrill Money Transfer is free Receiving money into your Skrill account is free Select your country and local currency.

Download active development mobile phones & portable devices driver. Customers can walk to any of the 25,000 eZ Cash outlets across the island and withdraw their remittances conveniently.

- Other Remittance

Partners

Features

- eZ Cash Remittances, is an online real time service that offers the easiest way to instantly receive foreign remittances directly to your mobile.

- Customers use these funds to multiple eZ Cash transactions such as pay bills, make utility payments, send money, etc.

Method

- Sender needs to visit any of the below mentioned partner web merchants abroad and provide the recipient's (eZ Cash customer′s) wallet number

- eZ Cash customer would be notified via an SMS instantly informing that he/she has received the money.

Limits Applicable

| Transaction Type | eZ Cash Account Category | Minimum Limit Per Transaction / Per day (Rs.) | Maximum Limit Per Transaction / Per day (Rs.) |

|---|---|---|---|

| Wallet Top-up | Classic Account | N/A | 10,000 |

| Power Account | N/A | 50,000 |

Introducing Payoneer, where you can receive payments for your freelance work directly to your eZ Cash account instantly.

How to link the payoneer account with eZ Cash

- Log in to the eZ Cash app and select Payoneer option

- Select ″Link″

- Enter the eZ Cash registered mobile number

- This message will pop up in the customer′s mobile. Please enter the eZ Cash PIN

- Request successful. Press dismiss

- The customer is directed to Payoneer page. Enter your Payoneer credentials and continue

Via web

Please visit - payoneer.ezcash.lk

How to transfer money from your Payoneer Account to your

eZ Cash account

- Open the eZ Cash App

- Select Remittance

- Select Payoneer

- Enter Amount In USD

- Confirm Transaction

Via USSD

- Dial #111#

- Select Foreign Remittances

- Select Payoneer Withdrawal

- Enter amount in USD

- Enter eZ Cash PIN to confirm the money transfer

- SMS receipt on transaction completion

Benefits

- Convenient

- Instant

- 600+ Commercial Bank outlets allow you to withdraw cash anytime, anywhere 24/7

Receivers

Get Foreign Remittances directly to the eZ Cash account on your mobile via UAE Exchange.

You can receive money from the United Arab Emirates via UAE Exchange direct to your eZ Cash account and use it to pay utility bills, transfer money and pay for a wide range of goods and services.

You will receive an SMS once the money has been sent from overseas to your eZ Cash account.

Withdraw your money from any of the 25,000+ eZ Cash outlets or Commercial Bank ATMs island wide.

Senders

UAE Exchange allows you to send money to your loved ones instantly and conveniently back home.

How to send via UAE Exchange

- Walk in to any UAE Exchange outlet

- Enter recipient′s eZ Cash account number and amount

- Receiver will get money to the eZ Cash account immediately.

Benefits sending via UAE Exchange

- Convenient

- Fast- receive money instantly to your eZ Cash account

- Low cost

- Countries – available from United Arab Emirates

- 600+ Commercial Bank ATMs located islandwide and open 24/7 allows you to withdraw money anywhere, anytime.

Instant low cost money transfer to Sri Lanka with NETELLER and eZ Cash with 2 options to choose from,

- Send money direct to Sri Lanka

Send money directly to an eZ Cash mobile wallet in Sri Lanka from your NETELLER account. All you need is the name and mobile number of the person you are sending funds to.∗

- Withdraw from your NETELLER account in Sri Lanka

You can withdraw money received to your NETELLER account directly from your eZ Cash mobile wallet in Sri Lanka.

∗ The person receiving the funds needs to have an eZ Cash mobile wallet.

Funds sent to an eZ Cash mobile wallet are received in Sri Lankan rupees and can be withdrawn in cash at thousands of local agents in Sri Lanka.

How to receive money?

- Log into www.neteller.com and create your Account

- Select Money Transfer - Login and select the Money Transfer option

- Enter recipient details - First name, last name and mobile number

- Confirm and send - The recipient will receive confirmation

Benefits of sending money to Sri Lanka with NETELLER

- Instant transfer including an SMS message confirmation of transaction and the new balance

- Immediate cash out with thousands of local agents and 600+ Commercial bank ATM′s available 7 days a week

Skrill ???????? ??? ????? eZ Cash ????? ?????? ????? ???? ??????

Posted by eZ Cash on Saturday, March 12, 2016eZ Cash has now partnered with Skrill to provide an array of services such as,

- Withdraw money you receive for freelance work from your Skrill account into your eZ Cash wallet

- Receive money from 200+ countries in the form eZ Cash

Receive money from 200+ countries via Skrill to your eZ Cash wallet

- Log into www.skrill.com and select 'International Money Transfers' and select 'Send Money Now' then select 'Sri Lanka'

- Select eZ Cash as the option

- Enter recipient details and then log into the account

- If you have sufficient balance in your Skrill account, then click ′Continue′ and double check transaction details and confirm

- Check Transaction details in ′All Transactions′

- The recipient will receive eZ Cash to his/her wallet

How to instantly transfer money from Skrill.com Account to eZ Cash Account?

- Log into www.skrill.com and create your Account

- Visit the ′Mobile Wallets′ section

- Add your eZ Cash Mobile Number

- Go to ′Account Overview′ and Click ′Withdraw′

- Select the Mobile Number, enter the amount and confirm

- Your will receive the money to your eZ Cash Account instantly

Receive Foreign Remittances direct through worldremit.com via eZ Cash

Use this service and receive an array of benefits such as,

- The possibility to send money to Sri Lanka from over 40+ countries.

- No rush for your loved ones as they can send money using a Debit/Credit Card by just logging into www.worldremit.com

- Instantly you can receive money directly to your mobile via eZ Cash

How to Send Money via worldremit.com to Sri Lanka

- Start with a person logging into www.worldremit.com

- Create an account and login

- Select the country you are sending from

- Select the country you are sending to (Sri Lanka)

- Select the Service (Mobile Money)

- Enter amount & sender′s details

- Select payment method & card details

- Confirm and send

Other Remittance Partners

Now you can receive money to your eZ Cash account instantly via TML, MoneyTrans, Barri, Dinex, Uber Remit, Lyca Mobile, Mama Money, Thunderbirds Ventures and MatchMove. Multiple partners across the world will allow you instantly send money to eZ Cash, either by visiting agent outlets or online.

Multiple Remittance Agents

Partner Merchants Abroad

Online

Thunderbirds Ventures –

Hong Kong

How to receive through above listed online partners

- Login to either one of the mentioned partner sites

- Register as a customer

- Enter credit/ debit card details

- Select Sri Lanka > eZ Cash > enter eZ Cash mobile number

- Receive money to your eZ Cash account instantly.

Customers can also access this benefit from 600+ Commercial Bank ATMs located island wide, 24/7.

Terms & Conditions

- You would receive money only in Rupees.(LKR)

- eZ Cash remittance service is available for customers of Dialog & Hutch.

- The maximum amount a customer could receive a day is Rs.50,000/=

- No minimum daily amount

- Standard eZ Cash charges will be applied when the customer wants to withdraw the remitted money

- No additional fee/charge for facilitating this service

For more information call 7111

These transactions are free:

- Paying a merchant directly from your Skrill wallet

- Receiving money to your Skrill account

- Sending money to an international bank account with Skrill Money Transfer

Local payment methods

Global payment methods

Please note that if you use your credit card for gambling purposes your issuer may charge a ‘cash advance' fee. This fee is outside Skrill’s control, and we receive no part of it.

Local payment methods

Global payment methods

Skrill Money Transfer

International Transfer

FreeNo fee when you use Skrill Money Transfer to send money to an international bank account.

International transfer in the same send and receive currency only

International transfer exchange rate mark-up

Up to 4.99%Exchange rate mark-up fee per transaction.

Domestic Transfer

Up to 2%Domestic fee per transaction. This fee will be charged when the transfer begins and ends in the same country.

Receive money

FreeSkrill Money Transfer does not charge recipients any fee to receive

Skrill to Skrill

Send money

Send Bitcoin From Skrill To Bitpay

1.45%*1.45%, min 0.50 EUR fee is applied if you have funded your wallet via Card or Bank Account.

*If you haven't made any deposit to your Skrill account, or have deposited via NETELLER, paysafecard or BitPay, a higher fee of 4.49%, min 0.50 EUR will apply.

From 27th April 2021 the Skrill to Skrill Send money fee for Skriller user level will become 2.99%. For True Skriller user level the Skrill to Skrill Send money will be free of charge.

FreeReceive money

Receiving money is always free of charge

You will see the applicable fee before you complete your transaction.

Keep Skrilling

Your Skrill account is free for personal use as long as you log in or make a transaction at least every 12 months.

Otherwise a service fee of EUR 5.00 (or equivalent) will be deducted monthly from your account.

Currency conversion

For transactions involving currency conversion Skrill adds a fee of 3.99% to our wholesale exchange rates. The exchange rates vary and will be applied immediately without notice to you.

Skrill To Bitcoin Exchange

Drivers coocox port devices. If your Skrill Account is denominated in a currency other than Euro, your Cryptocurrency Transactions will be subject to currency conversions. In this case, we will apply foreign exchange fee of 1.5%.

Prepaid card fees

Skrill To Bitcoin

Our fees are transparent, so you always know where you stand. Here are the fees we charge for using our Skrill Prepaid Mastercard®:

- 10 EUR card application

- 10 EUR annual fee

- 3.99 % FX fee; (Further details on the foreign exchange fee and the mark-up over the latest available foreign exchange reference rates issued by the European Central Bank (ECB) are available here.)

- 1.75 % ATM fee

- POS transactions are free

- Skrill virtual card application – first is free, any subsequent card is 2.5 EUR.

Simple and transparent fees

Crypto Buy / Crypto Sell | Fee: |

|---|---|

| Transactions up to EUR 19.99 | EUR 0.99 per transaction |

| Transactions between EUR 20 – EUR 99.99 | EUR 1.99 per transaction |

| Transactions above EUR 100 | 1.50 % per transaction |

Crypto P2P | Fee: 0.50 % per transaction |

Important Please note that the Skrill Cryptocurrency Service is not regulated by the Central Bank of Ireland. | |

In accordance with the Skrill Account Terms of Use:

| Provision of inaccurate or untruthful information and lack of cooperation fee (s. 4.5) | up to EUR 150 |

| Chargeback fee (s. 8.3) | EUR 25 per chargeback |

| Attempted cash upload fee (s. 8.12) | EUR 10 per upload |

| Prohibited Transactions fees (s. 11) | up to EUR 150 per instance |

| Reversal of a wrong transaction fee (s. 12.7) | up to EUR 25 per reversal attempt |